new fly book to publish!

Financial Literacy for Young People - Series 1

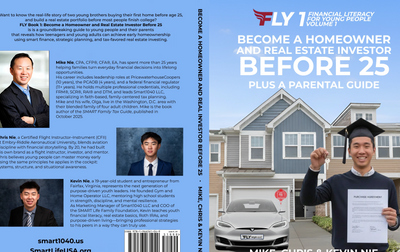

Become a Homeowner and Real Estate Investor Before 25 , with a Parental Guide to Financial Freedom]

Book audience

FLY Book 1: Become a Homeowner and Real Estate Investor Before 25 is the first book of Financial Literacy for Young people (FLY) book series. It is a guide that teaches young adults how to achieve early homeownership and build long-term wealth using real estate, tax planning, and disciplined financial habits. Through the real stories of Chris and Kevin Nie—who both bought homes at age 18—the book explains why real estate is a powerful wealth pillar, how leverage amplifies returns, and how young people can use low down payments, campus rentals, and tax benefits to accelerate financial independence before age 25. It also introduces the four major wealth pillars: stocks, cash-value life insurance, real estate, and crypto, showing how they balance risk and growth.

Pre-Order Form

Join the FLY Book #1 Preorder Community!

· If you are between 18 and 25, you will receive it for FREE, with your name and one sentence quote about wealth included in the book

· Parents: You are welcome to order with my autographed paper copy ($49) by PayPal to help@Smart1040.us

Early Praise from Dr. Thomas Forbang

“Real wealth is not built by comfort, shortcuts, or entitlement. It is built through discipline, patience, and the willingness to do hard things early in life. Become a Homeowner and Real Estate Investor Before 25 delivers this message clearly and honestly. This book does not promise easy money or quick wins. Instead, it challenges young people to think long-term, take responsibility, and build real assets step by step.

I have spent my life training the body, the mind, and the spirit. The same principles apply to building wealth. You must show up consistently, respect the fundamentals, and accept discomfort as part of growth. This book does exactly that. It gives young readers a practical path to ownership while reminding them that character, effort, and education matter just as much as money.

If more young people followed the mindset taught in this book, we would see fewer handouts and more hands raised to build, learn, and lead. This is the kind of financial education our next generation needs.”

— Dr. Thomas Forbang

Ph.D. | Real Estate Developer | IT Consultant

2018 National & International USA Yoga Champion

Early Praise from Dr. Maxwell Adekoje

“Time is the greatest asset a young person will ever have, yet it is the one most often wasted. Become a Homeowner and Real Estate Investor Before 25understands this truth. This book is not about getting rich fast. It is about getting started early, staying consistent, and letting time do the heavy lifting.

I have seen too many people wait for the ‘perfect moment’ to buy their first property, only to realize years later that the cost of waiting was far greater than the cost of starting. This book teaches young people what schools rarely do: ownership creates freedom, income replaces stress, and action beats intention every time.

If you plant the right seeds early, your future does not depend on luck. It depends on discipline and decisions. Become a Homeowner and Real Estate Investor Before 25 gives young readers the mindset and direction they need to build lasting wealth while they still have time on their side.”

— Dr. Maxwell Adekoje

Real Estate Investor | Mentor | Author of Just Eat the Worm

Early Praise from Brett Korade, US Navy, Ret.

“Most people are not held back by a lack of opportunity. They are held back by fear, impatience, and a mindset shaped by short-term thinking. Own a Rental Under 25 challenges that mindset head-on. This book teaches young people to think strategically, act intentionally, and use leverage wisely rather than living paycheck to paycheck.

Real estate rewards discipline, delayed gratification, and consistency. Those lessons are missing in today’s culture of instant results and easy credit. This book does not glamorize shortcuts. It teaches responsibility, mentorship, and the courage to take the first step even when it feels uncomfortable.

If you want to build real wealth, real character, and real freedom, you must be willing to start early and stay the course. Own a Rental Under 25 is a powerful guide for young people who are ready to lead their lives with purpose instead of drifting with the crowd.”

— Brett Korade

Luxury Real Estate Advisor

LAB Realty Group | Keller Williams

Washingtonian’s Best 2025

Book Published: The Smart Family Tax Guide

FOR IMMEDIATE RELEASE

Empowering Families to Take Control of Their Finances:

“The SMART Family Tax Guide” by Mike Nie, CPA, CFP®, CFA®, EA

Gaithersburg, MD and Fairfax, VA — October 7, 2025 — Families across America now have a clear, faith-based roadmap to keep more of what they earn. In his new book, The SMART Family Tax Guide: 101 Ways to Keep More of What You Earn, Christian father, CPA, and financial coach Mike Nie shares a lifetime of wisdom gained from helping hundreds of families navigate the U.S. tax system with confidence, purpose, and peace of mind.

With over 27 years of experience in public accounting, tax planning, and business coaching, Mike Nie distills complex tax strategies into simple, actionable steps designed for everyday families — not just the wealthy. “This book is about clarity, consistency, and concrete steps,” says Nie. “The tax code is full of opportunities, but most hardworking families never hear about them. I wrote this guide so every household — whether earning $60,000 or $600,000 — can apply the same principles used by top advisors.”

Through real-life examples, faith-based insights, and plain-language explanations, The SMART Family Tax Guide empowers families to:

- Strategies on investment, retirement, education, and real estate

- Maximize deductions, credits, and retirement savings tools like HSAs and Roth IRAs

- Access the tax-pro knowledge base and IRS publications

- Reduce taxes using proven, time-tested strategies

- Train young generation with faith, family value, and future goals

Mike Nie’s professional journey began at PricewaterhouseCoopers (PwC) as an Audit and Advisory Director, followed by leadership roles at the Public Company Accounting Oversight Board (PCAOB) and a federal financial regulatory agency. Today, he leads Smart 1040 LLC, a Virginia and Maryland-based tax strategy and family wealth advisory firm specializing in proactive, faith-centered planning.

“Tax planning shouldn’t just happen once a year — it’s a family lifestyle,” says Nie. “I want readers to see that with small, consistent steps, they can turn everyday financial decisions into lifelong blessings.”

The SMART Family Tax Guide: 101 Ways to Keep More of What You Earn is available now on Amazon in paperback and eBook formats. Audio book will be available in November 2025.

For more information, visit www.Smart1040.us or contact Help@Smart1040.us.

About the Author

Mike Nie is a Christian father, tax strategist, and financial educator with over 25 years of experience helping families turn everyday decisions into lifelong opportunities. As a CPA, CFP®, CFA®, and IRS Enrolled Agent based in Gaithersburg, MD, Mike specializes in faith-based, family-centered tax planning—with a focus on proactive strategy, not just tax filing.

A proud dad in a blended family of four adult children—each navigating the complex path through college—Mike brings personal insight to topics like FAFSA optimization, 529 plans, Roth IRAs for teens, and turning tuition into tax-smart planning. His areas of expertise include real estate investing, S-Corp and LLC tax structures, and building family foundations (990-PF) that align with both faith and legacy.

Mike’s clients know him as a wise, down-to-earth advisor who makes complex tax law approachable—and even a little fun. Whether online or in person, he teaches workshops that blend technical clarity with Biblical principles, helping parents model stewardship, discipline, and financial empowerment for the next generation.

With each story and strategy he shares, Mike hopes to help families not just save on taxes—but grow closer, dream bigger, and build something that lasts.

Early Praises 1

“This book is a spiritual and financial blueprint, brilliantly merging vision, clarity, and action. In the tradition of transformational guides like The Soul of Prosperity, Mike Nie invites you to create not just a vision board—but a living covenant with your family’s financial future. Through stories, practical steps, and heartfelt reflection, this work reminds us: we don’t just build wealth—we become it.”

- Rev. Jim Webb, Author of Create a Self-Manifesting Vision Board and The Soul of Prosperity

Early Praises 2

Mike holds many licenses: CPA/CFP/CFA/EA, and in my more than 20 years of professional career, I have rarely encountered a peer with so many professional certifications.

In recent years, he has persistently conducted volunteer financial education seminars for our CAPA Chinese community every month, tirelessly sharing what he has learned and applied with everyone.

As a fellow professional, I admire his comprehensive knowledge system, envy his efficient execution ability, and appreciate his sincerity and chivalry. Now he has launched his first new book, and I am fortunate to be one of the three recommenders, so of course I have to support him in my social circle:

"Mike Nie's book 'The Smart Family Tax Guide: 101 Ways to Keep More of Your Earned Money' is more than just a guide—it's a blueprint for wealth planning for middle-class families. With a father's heart and a strategist's mind, Mike demonstrates that vision boards are not just for dreamers—they are tools for planners. Each chapter translates tax law into actionable steps for wealth accumulation. This book reflects what I have always believed: true financial planning starts with a vision and ends with results."

Yinan Fenley, CPA, FINRA RR | Former Deloitte Auditor | Tax Strategist for High-Net-Worth Families

Early Praises 3

"As a CPA, I found this book to be extremely helpful. It’s well-organized, resourceful, and full of practical insights on tax planning and tax strategy. It breaks down complex U.S. tax law concepts into clear, actionable steps, with real-life examples and useful resources throughout. Go FIRE! Highly recommended!"- Yuping P, Texas CPA

Early Praises 4

A Practical, Legacy‑Building Playbook

As a long-time advocate for family and charitable growth, Mike Nie delivers exactly what busy, values-driven families need: clear, actionable tax advice with a larger purpose. The Smart Family Tax Guide isn’t just about saving money—it’s about building a legacy.

Nie’s strength lies in his real-world teaching style: thoughtful, conversational, and rich with live examples. Whether you’re planning for retirement, managing rentals, or launching a family foundation, his 101 strategies are to-the-point and doable.

What makes this guide warm and personal is its focus on family impact. The foundation chapters illuminate how smart tax planning can align with your giving goals—without sacrificing compliance or financial soundness.

Overall, this is a must-read for any family serious about financial responsibility and long‑term legacy. Easy to understand, deeply practical, and inspiring—well-suited for anyone who wants to teach their kids more than just tax code.

Suzanne S. Elliott, MA, Ed.

H.O.T. YOGA on the Island

Healing. Original. Therapeutic.

Founder/Director/Lead Teacher/Professor

USA Yoga, Non-Profit Board Member

H.E.A.R.T., Non-Profit, Inc. Board Member

F.I.T. Fun Innovative Training &

W.A.Y. Wild About Yoga, Creator/Founder/Master Trainer/Coach

Early Praises 5

It is a really good read overall. I find the information helpful, the flow of the book is straightforward and logical, and for the people who are interested in managing their personal finances and taxes better, this can be a very useful resource for sure.

Rebecca Yeung

Independent Board Director

Fortune 50 Senior Executive

Author, What Rules?: Think Differently About Success and Cultivate a Happy Life

Early Praises 6

I really like the heart behind your book—it feels grounded in real life, and that's going to connect well with families who are trying to make smarter moves but don't know where to start. My suggestion would be to keep things as plain and accessible as possible—add more breakdowns in layman's terms where the content gets heavy. Maybe also break up some of the longer chapters or use formatting to highlight your main tips. Overall, it's valuable, but a few structural changes will make it even more approachable to non-tax professionals.

Lori Correa

Training Program Manager

Drake Software, Professional Tax Solutions

Early Praises 7

“Your book is SUPERB—so, it’s my pleasure. I’m hoping to get a few copies for my friends and relatives because it’s probably the most useful material I’ve ever seen on taxes!”

Frances A. Chiu, Ph.D.

Editor of nine award-winning books (2023-2025);

Author, The Routledge Guidebook to Paine’s Rights of Man;

Dissertation/thesis coach;

31x boosted writer on Medium;

Smith College A.B.; and

Oxford University, Ph.D.

Early Praises 8

" Mike breaks down intricate real estate tax strategies into clear, actionable steps suitable for investors at any level. This impactful book masterfully navigates and simplifies complex tax laws and regulations. Each page delivers game-changing advice, enriched with real-life case studies that bring the strategies to life." -- Fred W., Real Estate Professional

Exclusive Perks for Book Launch Supporters

When you buy a ticket to my launch, you’ll receive:

- A signed paperback or eBook at publication

- A handwritten thank-you note

- Your name in the Acknowledgments (“Special Thanks to…”)

- Access to my private Author Community for behind-the-scenes updates

- Early excerpts, including the Introduction, with a chance to give feedback

- A vote on the final book cover and title

- A bonus worksheet or toolkit inspired by the book

- Exclusive launch event invite (virtual Q&A or celebration)

- A sneak peek at future projects and offers

The Author

As a CPA with over 25 years of experience in finance, tax, and accounting, I wrote The Smart Family Tax Guide: 101 Ways to Keep More of What You Earn to fill a critical gap I’ve observed in the profession—while many CPAs act as information processors, few serve as true tax advisors. This book is my effort to change that by translating complex tax laws into practical, empowering strategies that help hardworking middle-class families build wealth, retire early, and create lasting legacies through ethical, informed tax planning.

How to Order: SMART Family Tax Guide Book Presale Ticket Entry Form - Google Forms

Routine Tax planning classes

six week small business tax planning training (each january)

Covered Topics

· 10 tax strategies for small business families (LLC filing Schedule C)

· Small business tax planning under new tax law on the horizon

· LLC business plan & record keeping template

· Auto expense deduction strategies

· How to hire children by personal LLC

· LLC retirement plan (solo 401(k) and matching)

· Home office strategies & Augusta rule

· Travel on business with family board of advisors

· Small business health & medical cost deduction

What format?

The format of this course will entail Zoom recordings, AI transcripts, and slides .

What time?

- Every Thursday 9pm EST

About Coach Mike, CPA, CFA, CFP, EA

six-week Family Foundation Class (each May)

Agenda

1. 10 IRS rules regarding family foundation (5%, 1.39%, 60%, 30%, 20%, 5 year, 3 year, and more)

2. 10 key documents to make your family foundation audit proof

3. 10 AI use cases regarding family foundation

4. 10 reasonable expenses you can deduct within your family foundation

5. 10 things you don’t know about family foundation

6. 10 family foundation 990 PF tax returns for your deep searching & learning

7. How to donate your RSU stocks into family foundation

8. How to establish cash value life insurance within your family foundation

9. How to use your family foundation to invest in crypto currency

10. How to use your family foundation to create career pathway for your children

Audience

- Mid to high-income families

AI Era Bonus

- Use Tax GPT to run your family foundation

Six week fly program (financial literacy for young pros)

Topics to cover

***Targeted to young professionals ages 25-35***

1. First job - employee benefits

2. First house - tax savings and credits

3. First marriage - MFJ or MFS

4. First rental - Schedule E

5. First baby - UTMA, 529, ESA and cash value whole life

Bonus Content

1. Tax planning around medical power of attorney & living trust

2. Tax strategies for your first LLC or side business/gig income

3. Tax benefits for solo 401(K), HSA and back door Roth IRA

Sponsored by Chinese American Network, a 501(c)(3) non profit

- Zoom class

- Recording

- One sign-up

- Parents able to listen in for free

Family Centered Real Estate Tax Strategies (each june)

Six week workshop

Zoom Class. Thursday in Chinese. Friday in English

9/12/2024 class 1

Topics (subject to change)

1. Schedule E deep dive

2. Section 121 and 1031 exchange combo

3. LLC & S corp and Rental Combo (IRS self-rental safe harbor)

4. Real estate professional – do’s and don’ts

5. Hire your child in rental

6. College campus rental with 529 distribution combo

7. Real estate K-1 case study

8. Real estate legacy planning: “swap until I drop”

9. Cost segregation strategy

10. Property management company strategy

Real Estate Tax Consulting

Experienced CPA provides expert tax consulting services for any tax issue you may be facing. Let us help you find the best solution for your tax needs.

SIX-WEEK FLY class (FINANCIAL LITERACY FOR YOUth) (each july

Zoom class every Thursday 8:30pm Eastern

Toward high school and college students

Tax matters you should know but college does not teach you

1. Ten strategies to fund college expenses.

2. How to use compound growth to achieve 'Let money work for you; not you work for the money."

3. Do not chase hot stocks. Do not chase hot girls.

4. Ten things to do for your eighteenth birthday.

5. Rich dad vs. Poor dad.

6. Professional and financial career advice in the AI age.

Prior year student feedback (Aileen from Columbia University)

S Corp Boot Camp – four weeks upon request

Tax Planning

- Tax planning strategies for S Corp small business owner

Tax Preparation

- Form 1120S deep dive

Bilingual Zoom class

- Zoom class with recording and materials (Thursday in Chinese, Friday in English)

Speakers

- Mike and Yinan are both seasoned CPAs (with Big Four prior working experience PwC and Deloitte)

Charity giving back

- Half of your tuition (50% of $300) will be donated to non profit such as CAPA.

tax tips for holiday season (each Thanksgiving & Christmas e

Tax Planning

Monthly tax workshops

Each 4th Tuesday of November and December

Fun to learn; fun to earn

Zoom ID 9049835892; PIN: CAPA

We provide audit-proof workpaper templates: Schedule C, E, home office, auto, donation and more

Licenses

- Certified Public Accountant (CPA® Virginia License# 34954, and Maryland License# 45099)

- Certified Financial Planner (CFP® License# 369879)

- Chartered Financial Analyst (CFA® License# 925101)

- IRS Enrolled Agent (License# 00148503-EA) / Preparer Tax ID Number (PTIN) P02488165 / EFIN #521309 / 1099 TCC 50T04

- Certified Tax Planner

- Financial Risk Manager (FRM® License# 991510)

- MBA (Finance, Robert H. Smith School of Business), University of Maryland at College Park

Management

- Bookkeeping: manage daily transactions

- Individual and small business: tax preparation

- College financial aid: FAFSA/CSS related tax filing

Advisory

- Tax planning: Reporting and advice to support growth

- Tax planning: college financial aid

- Tax planning: real estate investment

Serving Our Community

A seasoned CPA/CFP/CFA/MBA is happy to help you become tax smart.

"Do not strive to get rich; save your wisdom." Proverbs 23: 4.

Copyright © 2021-2025 Smart Tax and Smart Accounting - All Rights Reserved.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.